Spring/Summer 2022

A home next to azure waters, an apartment with stunning views of the cityscape, a villa with a garden full of chirping birds … these are what dreams are made of.

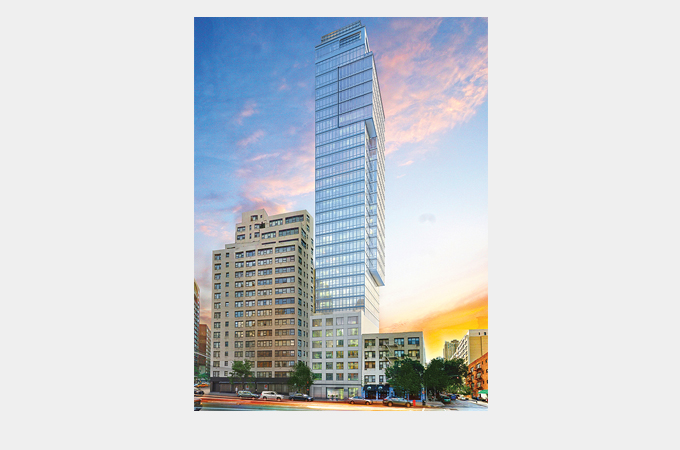

All these dreams can come true in Dubai, the dynamic UAE emirate that makes headlines for its superlative developments and initiatives and the prime property market in the city is heating up again.

Prime residential prices, encompassing the Palm Jumeirah, Emirates Hills and Jumeirah Bay Island, surged by 58.9% over the last 12 months, according to global real estate consultancy Knight Frank.

Arabian Knight’s Sree Bhat spoke to Arash Jalili, CEO of Unique Properties in Dubai, on the trends shaping the real estate market in Dubai, post-Covid-19.

Arash, who has nearly two decades of experience in the market, says luxury developments – apartments and villas in prime locations, waterfront villas and branded properties – are in high demand across the city.

“The measures taken by the government during the Covid-19 pandemic to ensure the health and safety of people is one of the main reasons for investors coming to Dubai at this time,” he says.

The proactive approach of the authorities resulted in about 95% of the city’s population getting fully vaccinated. “This instilled a sense of confidence in global investors to look at Dubai as an investment destination for their second homes,” remarks Arash.

He also highlights the fact that Dubai offers much more value for money compared to any major cities in the world. “When investors compare prices in big cities like London, Paris and New York, rates in Dubai are still much lower and buyers can get bigger properties with world-class amenities here,” he continues.

“Dubai also provides best-in-class education and healthcare facilities and, above all, it is one of the safest cities in the world. Many high-net-worth individuals who come on a visit to Dubai, make it their second home, such is the attraction of the city,” he remarks.

Dubai also provides a good return on investment. “Investors consider safety of investment, capital appreciation and rental income when they make the decision to buy a property. On all these counts, Dubai scores high,” he says.

“While we had ups and downs in capital appreciation, the rental returns have always been around 5% to 7% and you don’t have to pay tax on this… The main differentiator for Dubai is the services it offers. You can’t find such quality of service in other parts of the world,” Arash avers.

“Any part of Dubai you go to, it has an attraction. At some locations, it’s the waterfront, at others it’s luxury and in many others great facilities for families with parks and entertainment. The city provides for the requirements of each and every segment of buyers and investors are not limited to a few areas, there is a lot of variety to choose from,” he adds.

Arash also underscores the recent real estate investor-friendly regulations implemented in Dubai, including the Golden Visa.

“Golden Visa is open to a lot of people – investors, professionals, artists, etc. The easing of visa rules is a big attraction for investors who wish to do business from here. The UAE is a hub between the East and West and many business people are now trying to benefit from this geographic advantage,” Arash points out.

A lot of luxury property is bought by international investors, he notes. “In our business, earlier it was mostly the local and GCC buyers. However, last year, 60% of the buyers were international – mostly from Europe and Russia and the prices hovered around $4 million to $5 million.”

So, what do the HNWI buyers look for when they buy a property?

Different nationalities target different locations and tastes also vary. Europeans and Russians prefer beachfront properties, while Indian, Pakistani and other Asian nationalities – who are the No 1 investors in Dubai – are flexible on location and focus on facilities, he says.

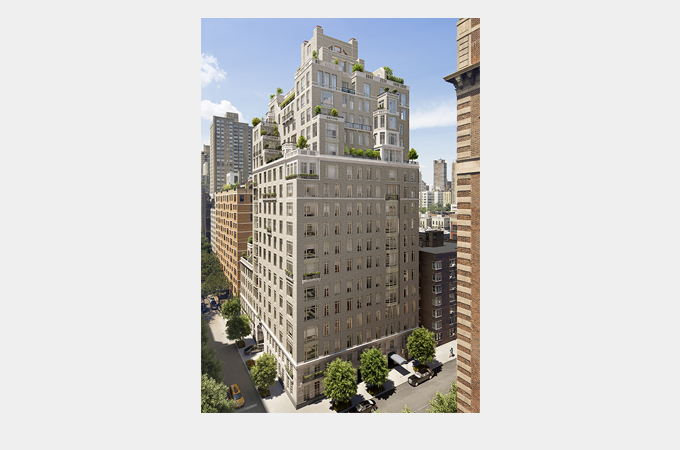

“Buyers, these days, are very knowledgeable and look for higher standards of construction and interiors. Most of the developers offer top quality products. Properties with high-end branding are also in big demand since it reflects the services and the quality of the building,” Arash notes.

There is also demand for “trophy homes” – the one closer to the unique attractions of Dubai, including Burj Khalifa, the world’s tallest tower.

Arash, who set up Unique Properties in 2008 in a small way with just three people, has seen it progress with the growth of the property market in Dubai.

“In 2008, when we established, the market was very easy and whatever we aimed for, we were able to achieve. Then the crash happened and it was painful for all of us; but at the end, I am happy I learnt my biggest lesson in life during the period. I learnt how to manage the business, how to manage the finance and how to have a vision for the company and implement it. The crash made us more mature.

“Today, we are one of the top real estate companies in Dubai. Last year, we achieved 170% increase in our sales revenue; and our team has grown to 140 strong professionals. Because of the opportunities we have here and the city’s infrastructure, we have been able to achieve this success,” he says, adding, “we are trying to expand and diversify the business into different countries now.”

“Dubai is a land of opportunities… There is no limitation if you are a doer and have a vision. We welcome investors,” he concludes.